How the group consolidation is initially configured, say with one method of translation across the P&L may not accord to the new or current reporting want, say from management restructure, new covenant obligation, or new filing requirement from ownership change.

The two principle methods for treatment of P&L translation are Year-To-Date (YTD) or Periodic. The first divides the YTD value by an individual average rate. The second divides each period’s movement value by an individual rate, the YTD value being the sum of these parts.

Group consolidations typically follow one of these methods, but over time, additional methods or translation asks can be added. Additional translation views often require design flexibility to accommodate both methods, which in turn can accommodate different rate choices.

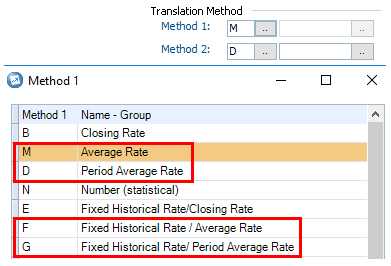

To therefore accommodate such translation flexibility, the first action is to update the account structure. You want all P&L accounts to be defined for translation by both Method 1 and Method 2, you typically want translation methods M (for YTD translation) and D (for Periodic translation) enabled in both cells. In doing so, please be consistent, say Method 1 belongs solely to translation code M. You may also need to pay consideration to the P&L translation methods that carry integration with historic rates and be consistent as appropriate. Method F pairs to Method M (for YTD translation), whereas Method G pairs to Method D (for Periodic translation).

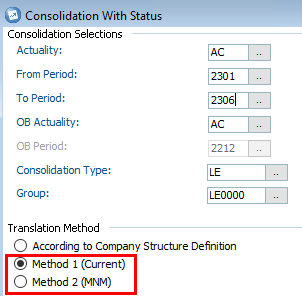

You next need to consider your data usage by actuality. Data is typically consolidated using the ‘Consolidate with Status’ function. You first consolidate by individual actuality and then select the ‘Translation Method’ to be used. For many customers, running with one standard method, the default usage of ‘According to Company Structure Definition’ suffices, but if you are wanting to create different P&L translation outcomes, then the options for changing consolidation selection to ‘Method 1’ or ‘Method 2’ should be chosen in alignment with the YTD or Periodic programming you have set within the account structure design, as noted above.

For example, you may run the AC actuality against Method 1 using the YTD translation method, and then run the AP actuality against Method 2 using the Periodic translation method.

Lastly, if you are to expand or adjust your P&L reporting in this direction, then please also be mindful toward:

- Updating Method 2 settings across all Balance Sheet account codes, do not just focus on P&L account codes for update. For Balance Sheet accounts this is typically a replication of Method 1 settings. This enables a full translation of all trial balance accounts under both approaches.

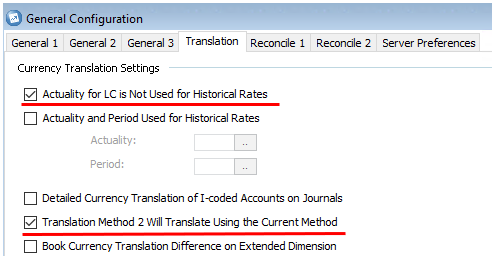

- Setting updates should also be considered within General Configuration, particularly where linked actualities are being used. For example, the AP actuality of above could have been linked to AC for local numbers. Settings that may require update, include: